[PREDICTION] What The Dallas Multifamily Market Could Look Like in 2023

- Peter

- Mar 23, 2023

- 9 min read

Updated: Mar 24, 2023

Looking to know everything about the Dallas Multifamily Market in 2023? If so, this blog will show you everything you need to know. Let’s start off with the big picture:

Economy & Population Trends

The Dallas unemployment rate continues to make drastic improvements. Unemployment rates for the Dallas-Fort Worth (DFW) metroplex have dropped from 3.6% to 3.2% from December 2021 to December 2022, respectively. According to the inaugural report of the American Growth Project, the DFW has registered as the nation’s fifth fastest growing economy among major U.S. cities in 2022.

As of 2022, DFW’s GDP grew by 3.1%, adding $682 billion to the local economy. This ranked DFW as 7th in the nation for GDP. The DFW added 97,290 people between June 2020 and July 2021, with the main reason for this increase being new migrants. “The region’s persistent attractiveness to new migrants is likely due — at least in part — to its diversity and strength across industries.”

Texas led the U.S. in job growth in 2022, adding 650,100 nonfarm payroll jobs.

DFW’s 5th ranked economy is anchored by 23 Fortune 500 companies, and the Metroplex is one of the nation's top growth centers. People relocating seek DFW as much as any other U.S. urban area.

Between 2010 and 2020, DFW added 1.2 million people (more than any other city in the country.) According to Macrotrends, the current metro area population of DFW in 2023 is 6,574,000, a 1.3% increase from 2022. This figure is expected to increase to 7,380,000 by 2035.

Source: Macrotrends.

We note a significant trend of Californians migrating to Texas. “Based on state-to-state migration figures from the U.S. Census Bureau — net migration from California to Texas in 2018 and 2019 was between 45,000 and 50,000 people per year. That’s about one-tenth of 1% of California’s population. In 2017 — the year of Hurricane Harvey — the net migration was only 22,000. It has doubled since then.”

Why is DFW receiving an influx of interstate migration from California?

Source: IPA Institutional Property Advisors

Houses are more affordable — According to Zwillow, the average home value in California is $618,016. In Texas, it’s $222,507.

Income tax is not levied against individuals — no state tax against individuals.

Living costs are lower — Texas offers most of the amenities California offers, but the cost of living is lower across the board

Better urban planning — LA has some of the most congested freeways in the world, with minimal greenspace due to sprawling expanse. Dallas has more natural green areas, and is a more pleasant place to live.

Texas is more conservative than California — for conservative minded Californians, Texas offers like-minded individuals to mingle with. Texas also has fewer business regulations, a lower minimum wage, limited power for unions and organized labor, and more lax firearm laws.

Ok, so why are Californians choosing the Dallas-Fort Worth area? Anecdotally speaking, people from California would rather move to Dallas-Fort Worth than Houston. Houston is hot and muggy, with the city claiming the title of “third most humid city in the United States.” On average, the humidity is 75% in Houston, with the ideal humidity level for humans range from 30 to 50%.

What does this mean for multifamily property?

This new ranking by the inaugural report of the American Growth Project displays DFW’s dominance in the nation as a highly desirable city for families and businesses alike to migrate. Employment opportunities are continuing to expand, further adding to the desirability of Houston. Increasing migration to the DFW area is resulting in a sharp need for more apartments.

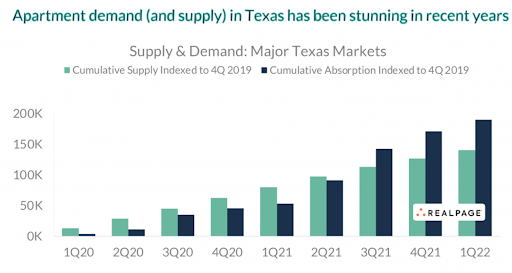

The supply of apartments in DFW has continued to grow, but demand has been outstripping supply. According to Realpage Analytics:

“The existing unit count in the state of Texas has grown by 140,000 new apartments over the past two years, which increased the state’s existing inventory base roughly 6%. While new supply volumes have been incredibly high, however, Texas demand is even better. Remarkable levels of absorption in the state resulted in total demand of roughly 190,000 units in the past two years. That works out to about 8% more occupied units today than at the start of 2020.”

Source: RealPage, Inc

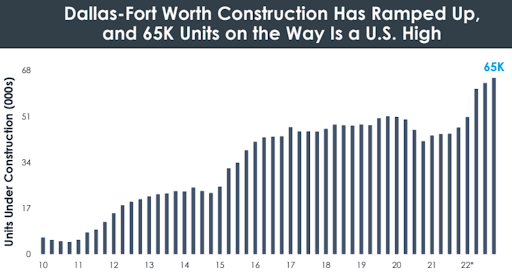

Source: RealPage, Inc, IPA Research Services

The DFW area is forecasted to see the highest level of apartment completions in the U.S, with 25,000 additional apartments ready by the end of 2023.

Source: RealPage, Inc, IPA Research Services, CoStar Group, Inc

With a robust economy, strong levels of population growth, and high levels of demand, multifamily property is predicted to remain a valuable asset for years to come.

Leasing Market

DFW multifamily rents are still on the rise as of November 2022. According to Colliers, the average rental rate has increased from $1,085 per month to $1,412 per month over the past 5 years. DFW multifamily rental rates have increased 30% since 2017, and up 17% this year alone.

Rent increases have been sustained by immense demand for rental housing in DFW. Vacancy rates have declined significantly in the past year, now less than 4%. As less people are owning homes, more renters are flooding the DFW market. This will keep DFW multifamily vacancy rates circa 4% for the foreseeable future.

Source: Colliers Research

Another factor to look at is the growing difference of affordability rates between owning a home (and paying through a mortgage) versus leasing an apartment. In the end of 2022, that gap has increased to over $1,800 a month. This means that it has become increasingly more expensive to own a home and pay a mortgage than to find temporary housing. This pushes the median house purchase price higher and increases the desirability of leasing an apartment.

Source: IPA

What does this mean for you?

Multifamily is a secure asset, especially when compared to other forms of commercial real estate, such as retail or office. It’s simple, but true: people always need a home to live in.

Capitalization Rates (Cap Rates) / Yields

According to Colliers Research, median cap rates have increased from 4% to 4.25% for the DFW market. The overall Texas median cap rate has also increased from 4.1% to 4.3%, and U.S. median cap rates have increased from 5% to 5.5% (as of Q4 2022.)

Source: Colliers Research

What effect does this have on DFW’s multifamily market?

Rising cap rates imply lower prices for the same amount of rent. Assuming we have a 10% cap rate, a $1,000,000 multifamily property would generate $100,000 in rental income per year. Meaning it would take 10 years to cover the cost of acquisition (this obviously isn’t including debt servicing, agents fees, interest rates, etc. We use the Internal Rate of Return — IRR — to get an accurate measure on what’s feasible.) Compare this to a 5% cap rate. The same $1,000,000 property would only generate $50,000 — taking you 20 years to cover the cost of the acquisition.

It’s counterintuitive, but higher cap rates are a greater deal for investors — worse for vendors/sellers. This basically means: the properties on the market are cheaper, and you get a greater return on investment (ROI.)

Major New Developments / Infrastructure / Industries

Universal Theme Park North Texas

Source: Universal, Travel Weekly

Theme Park operator, Universal Parks & Resorts, have earmarked a theme park for the suburb of Frisco, Dallas. The theme park is a new concept for Universal, featuring themed lands. According to Universal, the design is, “more intimate and engaging for younger audiences.”

It will be a regional park, featuring:

Attractions

Shows

Character meet-and-greets

And food & beverage venues

The park is set on 97 acres of land, with Universal intending on constructing an adjacent hotel (and potential further expansion of the theme park.)

So, why choose Frisco?

According to Page Thompson, president of new ventures for Universal Parks & Resorts, "We think North Texas is the perfect place to launch this unique park for families given its growing popularity within this part of the country.”

Universal has not released any further details pertaining to the theme park’s capacity.

Hotel & Hospitality Redevelopments

147 hotel construction projects, with more than 17,700 new rooms, are now in the pipeline in the DFW area. These new figures match Atlanta as the U.S.’s top hotel building market.

So, why so many new hotels in the DFW area?

According to VisitDallas CEO Craig Davis, “The fact is that we are such a business-friendly city. We have this culture of continuing to build and not stop,”

Dallas City council also approved plans for a new 2.5 million square foot convention center located near the current Kay Bailey Hutchison Convention Center Dallas. The new center will feature:

800,000 square feet of exhibit space

400,000 square feet of breakout space (with a 100,000 square foot ballroom)

Construction on the $2 billion center is expected to begin in 2024, with completion for circa 2028.

Business travel has returned to pre-pandemic norms (especially in DFW)

There are many large corporations already headquartered in the DFW, with many corporations also looking to move to DFW

DFW has a very diversified business sector (investment banking, oil, development, technology and health care)

DFW has an excellent entertainment and robust tourist attractions that feed its tourism

$13.9 billion in funding for Texas

Source: The White House

As of November 2022, $13.9 billion in funding has been announced for Texas. This figure is allocated over 310 projects, with the total figure second only to California’s $16.2 billion.

The vast majority, $10.8 billion, is earmarked for upgrades to roads, bridges, and roadway safety. Several highway projects receiving improvements are in the DFW area, including Interstate 635 and near Loop 12.

Texas has also allocated funds in many other areas:

$645 million for public transit

$246 million for clear energy and energy efficiency

$147 million to build out a network of electric vehicle chargers

Chandra Bhat, a professor in transportation engineering at the University of Texas at Austin, noted the higher spending on new technologies, including the $35 million allocated for a new zero-carbon power plant at Dallas-Fort Worth Airport. “All these technology investments are moving us in the right direction,” said Bhat

Texas has also allocated a $25 million grant to improve bicycle and pedestrian routes around multiple transit stations in the DFW area. The project calls for building over 30 miles of sidewalks within a half-mile radius of several DART light rail stations. The Cedar Crest Traill will also be extended about 1.5 miles.

Recap

Rental rates in DFW are predicted to significantly increase. Cap rates are insignificantly increasing, making multifamily a highly sought after asset class.

Multifamily is an attractive proposition for investors seeking to hedge their bets against inflation. As inflation continues to escalate, rental rates will continue to rise. When compared to other forms of commercial real estate, like retail or office, multifamily is a secure vehicle to protect yourself against inflation.

Not only that, inflationary environments are often favorable for multifamily investments. Higher mortgage repayments increase the number of renters in the market, as they’re unable to purchase a home.

Here are some other benefits of investing in multifamily real estate:

When you own a commercial multifamily property, you don’t have to deal with tenants (and it can be 100% passive.)

When most people think of real estate, they think of being a landlord for a single family home.

But being a landlord isn’t a passive activity. It requires dealing with tenants, toilets, and occasionally taking out the trash. When you become an owner of a commercial multifamily property, you are buying a business that can run (without you dealing with the day to day.)

We utilize a property management company and onsite maintenance crew to address these issues and the asset management team.

2. Multifamily kicks out cash flow that beats the dividends from stocks.

3. Multifamily allows for forced appreciation.

We can improve the property and increase the net operating income (either by increasing the revenue or decreasing the expenses). This increases the value of the property, and at sale we’re able to see those gains from the work that was done.

This is how we’re able to achieve 15-20% returns annually (and is one of the best kept secrets in multifamily.)

4. It’s not directly tied to the value of the offset properties.

5. Because apartments have pricing power, we are able to pass the expenses onto the consumer (It’s also an inflation hedge.)

6. Utilize a tax deferral strategy that will help grow your wealth faster.

One of the big secrets is that our government gives us incentives to provide housing. They allow us to depreciate these assets as a write-off and take paper losses. This is one way the rich avoid paying taxes.

Investing in a multifamily project has many advantages as, on balance, real estate offers lower economic and inflationary risks than stocks.

Of course, the decision to invest in real estate or invest in stocks or bonds or other asset classes, which offer different risks and opportunities, is a choice which depends on an investor's risk tolerance, objectives, financial status and investment style.

If you’d like to know more about multifamily investing please feel free to contact us for a no obligation chat or subscribe to our upcoming newsletters.

Yours sincerely,

Anna and Peter Tan

SuiteLifeMF has acquired, operated and invested in real estate for over 10+ years, investing in over 1500 doors and with over US$ 100 under management (900+ doors). The company also operates a property management company which handles a portfolio of single family homes.

SuiteLifeMF maintains a disciplined approach to investing, which focuses on capital preservation and strong returns with a deep understanding of submarkets, economic and political situations.

Ask a question or post an update…

![[PREDICTION] What The Houston Multifamily Market Could Look Like in 2023](https://static.wixstatic.com/media/11062b_bbd10b2e4ada47caaedd174e528991eb~mv2.jpg/v1/fill/w_980,h_654,al_c,q_85,usm_0.66_1.00_0.01,enc_avif,quality_auto/11062b_bbd10b2e4ada47caaedd174e528991eb~mv2.jpg)

Comments